Wealth Management Services Tailored for Cincinnati Residents

Are you tired of feeling lost when planning financial futures in Cincinnati? This post offers clear insights into wealth management services tailored for Cincinnati residents, focusing on key features and common challenges they face. Readers will find practical advice to choose the right firm and learn how evolving trends can solve everyday financial issues. By the end, Cincinnati advisors and clients alike will better understand how to enhance their financial well-being with proven strategies.

Key Takeaways

- the firm supports advisors to deliver tailored virtual family office services

- advisors help clients manage risk with clear, actionable planning

- transparent fee structures and personalized sessions build trust in financial management

- practical digital tools simplify portfolio tracking and improve decision-making

- local case studies show measurable improvements in asset allocation and risk management

Understanding Wealth Management Services in Cincinnati

Cincinnati residents benefit from wealth management services that define financial planning. The explanation covers common views and tailored approaches addressing tax, estate planning, and wealth creation. It offers insights from a certified financial planner board of standards and shows importance for Cincinnati residents, contrasting local needs with tips from New Jersey advisors. This overview paves the way for practical, straightforward guidance.

Defining Wealth Management Services

Wealth management services refer to the range of financial planning strategies that help Cincinnati residents manage their portfolios, secure their futures, and build a strong foundation for asset management. In many cases, these services integrate detailed analyses on mergers and acquisitions and insights from experts in markets like Wisconsin to provide clients with hands-on guidance:

In practice, these services also include recommendations on asset allocation and risk management tailored for Cincinnati residents. Clients receive actionable advice that addresses security needs and enhances portfolio performance while drawing on real-world examples to simplify complex financial concepts.

Importance for Cincinnati Residents

Cleveland residents find value in working with an investment advisory firm that recognizes local challenges and opportunities. Through platforms like uagria.online, advisors based in an LLC framework in Ohio offer strategies that help manage risk while guiding clients toward solid asset planning.

The approach, rooted in practical expertise, delivers straightforward insights needed by Cincinnati residents seeking reliable advice. Tailored services provide clear information on managing risk and investment strategies, ensuring that each client receives personalized and action-oriented guidance.

Tailored Approaches for Local Needs

The firm focuses on tailored financial management for Cincinnati residents by addressing local needs with hands-on expertise. It provides solid insurance guidance alongside personalized private wealth strategies that resonate with the lifestyle of locals, similar to enjoying an Arnold Palmer on a sunny day, while ensuring reliable investment outcomes.

The approach emphasizes practical investment ideas that align with individual goals, pairing sound management advice with clear insurance options. Advisors offer actionable steps to secure private wealth that reflect community spirit and a relaxed yet results-driven style reminiscent of the classic Arnold Palmer mindset.

Common Misconceptions About Wealth Management

The perception that wealth management is only for the ultra-wealthy often leads Cincinnati residents to overlook simple yet effective strategies provided by a dedicated wealth manager. This misconception can hinder proper accounting and financial planning using services like those associated with United Advisor Group:

Many people mistakenly view wealth management as a complex field reserved for specialized groups, failing to realize that even basic financial planning techniques can significantly improve their future. In Cincinnati, wealth management practices provide actionable insights that bring practical value to daily fiscal decisions, using proven methods from United Advisor Group and trusted accounting practices.

The discussion of wealth management in Cincinnati has set a solid base. It now turns to the standout features that make these services work best.

Key Features of Wealth Management Services

Personalized financial planning, investment management strategies, risk assessment, estate planning, and tax optimization techniques form the core of wealth management services for Cincinnati residents. The content offers practical finance insights to boost net worth with input from private money managers who have been vetted by top RIA firms like United Advisor Group and ideas akin to approaches seen in tennessee, ensuring clear, actionable advice that aligns with local financial goals.

Personalized Financial Planning

The firm offers personalized financial planning that truly caters to Cincinnati residents, backed by years of expertise from an experienced financial adviser team. The company integrates best practices from financial services around cities like Jersey and Miami, providing tailored strategies that address each client’s unique fiscal landscape.

Clients benefit from clear, action-oriented guidance that turns complex decisions into manageable steps. The financial adviser team at the company uses practical insights drawn from top financial services to deliver plans that alleviate common pain points and simplify financial management for all.

Investment Management Strategies

The firm’s wealth advisors use data-driven techniques to design investment management strategies that help clients plan for their long-term business goals. Their experienced financial planner team ensures that each financial advisor tailors recommendations to fit the specific needs of Cincinnati residents, addressing common investment challenges while boosting confidence in managing their futures.

Investment management strategies crafted by the firm rely on hands-on expertise and clear guidance from wealth advisors. By working closely with each business and incorporating insights from a seasoned financial planner, the financial advisor team simplifies decision-making, making complex investment concepts more approachable for Cincinnati residents.

Risk Assessment and Management Services

The risk assessment and management services offer practical steps to protect personal assets and support future financial decisions for Cincinnati residents. A group of financial advisors uses real-life experience and modern marketing ideas to deliver strategies that address clients’ concerns effectively.

The process includes clear, actionable steps inspired by examples from established practices in New York City and proven expertise. The service steps are as follows:

- Thorough risk evaluation techniques

- Strategic planning for asset protection

- Ongoing performance review and adjustment

Estate Planning Considerations

The importance of estate planning for Cincinnati residents is highlighted by a commitment to clear strategies that include proper allocation of assets under management and transparent fee structures. A seasoned fiduciary approach guides clients through decisions that build trust, ensuring that every handshake with an advisor represents a secure commitment to their future:

- Assessment of assets under management

- Clear explanation of fee structures

- Reliable guidance from experts featured in Forbes

With practical steps and a friendly approach, the process emphasizes actionable insights that support lasting financial security. A strong fiduciary ethic and a straightforward handshake between client and advisor cement a relationship that values transparency and real results.

Tax Optimization Techniques

Tax optimization techniques help Cincinnati residents manage their asset allocation efficiently while reducing tax burdens. Wealth management firms provide clear guidance on strategic investment management and philanthropy, ensuring that each client takes actionable steps toward financial stability and growth.

Practical advice from experienced advisors makes it easier for locals to apply tax-saving strategies that align with overall wealth management goals. This approach offers straightforward and relatable insights that benefit not only Cincinnati but also neighboring regions like greater cleveland, making financial planning clear and effective.

The team built its services on solid, clear principles that resonate with hard work and trust. Now, they turn their focus to finding firms in Cincinnati that match this clear commitment to client care.

Choosing the Right Wealth Management Firm in Cincinnati

This section breaks down key factors for selecting a wealth management firm in Cincinnati. It covers credentials and experience to look for, client-focused methods, clear fee structures, and reputation checks, including reviews from areas like Cincinnati. Each topic guides readers through practical and straightforward steps for informed decision-making.

Credentials and Experience to Look For

The firm prioritizes credentials that illustrate a strong background in wealth management, such as professional certifications and continuous education in financial planning. Experienced advisors with solid track records provide tangible examples of successful asset management and risk planning for Cincinnati residents.

When reviewing a firm’s qualifications, the reader should look for proven expertise and verified client testimonials:

Client-Centric Approaches

The firm focuses on putting client needs first, using clear communication and tailored strategies to solve common challenges. Each client receives personalized financial guidance that simplifies decision-making and builds confidence in their financial plans:

The advisors place great emphasis on listenership, consistently adapting their approach based on individual feedback and market trends. This method ensures that Cincinnati residents receive frequent, useful guidance that directly meets their unique financial objectives.

Transparency in Fees and Services

The firm ensures complete clarity with its fee structures and service outlines, meeting the needs of Cincinnati residents while detailing all charges and benefits. Detailed communication and accessible documentation help build trust and support informed decision-making.

The transparent approach includes easy-to-read charts that summarize fee components and service features:

Evaluating Reputation and Reviews

Cincinnati financial advisors suggest evaluating a firm’s reputation by checking online reviews and hearing direct feedback from local clients. They stress the value of verified testimonials and consistent ratings, which offer a clear picture of the firm’s performance and service quality for wealth management needs.

Advisors recommend seeking professionals with a strong standing in the community and a proven track record of reliable wealth management services in Cincinnati. They find that honest client reviews deliver practical insights and help prospective clients make informed decisions that address everyday financial challenges.

Cincinnati advisors now turn their attention to fresh trends reshaping the wealth landscape. The steady pulse of change promises new insights and practical paths forward for dedicated professionals.

Wealth Management Trends in Cincinnati

Cincinnati residents see shifts in wealth management trends, including sustainable investing, economic change impacts, technology reshaping advice, and a boost in financial literacy. Each topic offers practical insights to address everyday challenges and enhance financial strategies tailored for the local community.

Rise of Sustainable Investing

Recent trends show Cincinnati residents increasingly choose sustainable investing as a way to support environmental practices while growing their portfolios. This shift in wealth management services reflects practical strategies that balance fiscal growth with community values:

Local financial experts show that incorporating sustainable investments into portfolios offers practical solutions for clients looking to merge fiscal discipline with a commitment to social responsibility. Their advice helps residents take actionable steps towards achieving clearer financial goals while supporting causes close to home.

Impact of Economic Changes on Wealth Management

The firm observes that shifts in the economy often lead to changes in wealth management strategies for Cincinnati residents. Economic fluctuations create challenges that prompt financial advisors to update portfolio strategies and risk management practices based on real market conditions.

Financial professionals note that each economic change requires a tailored approach to safeguard investments and maintain steady growth. By focusing on practical steps and clear guidance, the team helps clients adjust their financial plans in response to new market realities.

Technology’s Role in Wealth Management

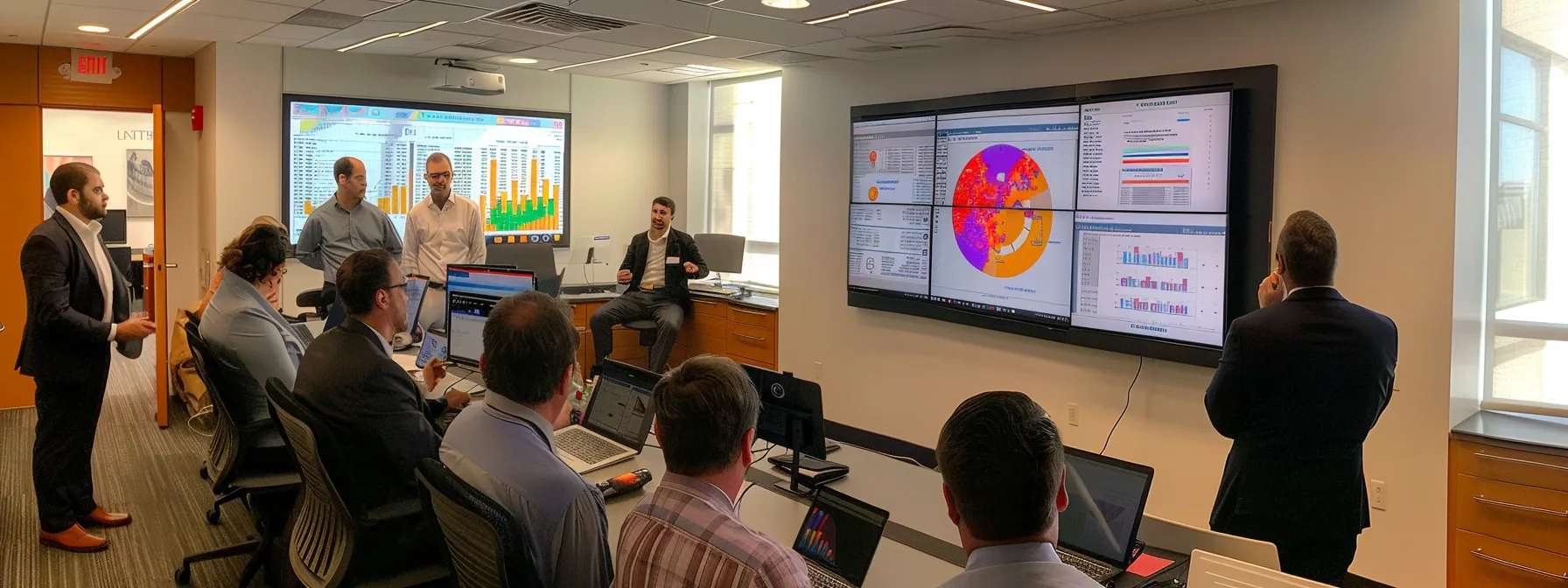

The role of digital solutions in wealth management has grown steadily as advisors use investment software and online platforms to deliver clear and efficient strategies for Cincinnati residents. Clients see practical benefits as technology simplifies tracking portfolios and provides real-time updates for streamlined financial planning:

Wealth management technology offers a friendly and straightforward way to keep financial goals in sight while addressing everyday challenges. Practical advice from experienced advisors using digital tools helps Cincinnati residents manage risk and encourage proactive investment decisions.

The Growing Importance of Financial Literacy

Cincinnati residents increasingly recognize the value of financial literacy in making sound wealth management decisions. Research shows that informed clients are more likely to achieve their financial goals through tailored wealth management services designed to meet their specific needs.

Experts observe that a focus on clear financial education helps individuals avoid common pitfalls and build stronger investment strategies. This practical approach to financial literacy fosters confidence in managing assets and planning for the future in a straightforward and accessible manner.

Trends have sharpened focus on smart money moves in Cincinnati. Local residents face real challenges that call for practical solutions.

Common Challenges for Cincinnati Residents

Cincinnati residents face several challenges in managing their wealth. They must navigate market volatility, plan for retirement expenses, address multi-generational wealth concerns, and manage local economic factors. Each area offers practical insights to build robust financial strategies that align with everyday needs while sustaining long-term financial success.

Navigating Market Volatility

The firm advises clients to stay focused and adapt their strategies during times of market volatility by relying on clear data and straightforward guidance. Expert advisors monitor market movements and provide tailored insights to help residents manage risk with practical advice and hands-on support:

The team encourages residents to use actionable steps that demystify complex market trends, making financial decisions simpler. Clear instructions and regular updates help individuals maintain balance and confidence in their financial plans during uncertain times.

Planning for Retirement Expenses

Financial advisors note that planning for retirement expenses is a key concern for Cincinnati residents. They offer clear steps to help clients prepare effectively for their future, including a straightforward breakdown of necessary actions:

- Assess current savings and future needs

- Review income projections post-retirement

- Set up a flexible withdrawal strategy

Practical guidance from experienced advisors equips clients with tools to navigate financial needs during retirement. Experts help individuals outline their financial goals and identify ways to minimize risks, ensuring a stable and predictable income stream to cover retirement expenses.

Addressing Multi-Generational Wealth Concerns

Cincinnati residents often worry about transferring wealth across generations while ensuring everyone’s needs are met. Experienced advisors propose actionable strategies that simplify inheritance planning and secure long-term financial stability for each family member. These professionals use practical examples that help families understand the best steps to protect and distribute their assets.

The experts stress the importance of clear communication and regularly reviewed plans to avoid conflicts and confusion. They provide straightforward guidance that makes multi-generational wealth planning approachable for each family, showing that careful planning can ease financial concerns and build a solid foundation for future generations.

Dealing With Local Economic Factors

Cincinnati residents face local economic factors that shape their wealth management decisions, and experienced advisors help by highlighting practical steps to manage income fluctuations and cost changes. The firm regularly reviews market trends to provide clear guidance tailored to help individuals adjust their asset allocation in response to local conditions.

The approach aims to simplify financial decisions amid shifting local economic factors by offering actionable insights that support steady growth. Experts focus on delivering straightforward strategies that directly address everyday challenges, ensuring that every client feels confident about their financial plan.

Many in Cincinnati faced hard times, but some found a way out. Real results from trusted advisors now light the path forward.

Success Stories in Cincinnati‘s Wealth Management Sector

Local success stories highlight case studies of local clients, innovations by Cincinnati wealth management firms, testimonials from satisfied clients, and the impact of wealth management on local communities. Each topic offers clear insights into how tailored financial strategies benefit residents, improving client outcomes and strengthening community ties.

Case Studies of Local Clients

United Advisor Group helped a local client in Cincinnati effectively transition their portfolio management strategy, resulting in improved asset allocation and minimized risks. The practical approach provided clearer steps with real-life examples and actionable insights that were easy to follow, leading to noticeable gains in confidence and financial outcomes:

- Comprehensive risk evaluation

- Clear fee structures and transparent communication

- Personalized financial planning sessions

Another case involved a family seeking a virtual family office experience tailored to their unique needs, where experienced advisors delivered focused guidance on tax efficiency and wealth management strategies. This success story highlights how straightforward, locally informed financial planning can address pain points while consistently producing measurable improvements in clients’ financial futures.

Innovations by Cincinnati Wealth Management Firms

The firm is leading the way with fresh ideas designed to meet the unique needs of local clients. It offers practical digital tools and personalized services that simplify financial decision-making while providing clear, step-by-step results.

Clients have reported noticeable improvements from these innovations, which include user-friendly online dashboards and real-time portfolio tracking solutions:

Testimonials From Satisfied Clients

The firm received positive feedback from clients who experienced measurable improvements in their financial futures. Satisfied investors in Cincinnati appreciate the board-certified team’s practical guidance and tailored wealth management strategies that simplify complex decisions.

Clients shared their experiences clearly and concisely, offering actionable insights on how personalized financial planning delivers dependable results:

- Enhanced asset allocation

- Straightforward fee structures

- Focused risk management

Their testimonials underline the confidence they have in the clear, client-centered approach that sets this wealth management service apart.

Impact of Wealth Management on Local Communities

Local communities in Cincinnati have seen practical improvements thanks to clear wealth management strategies that support everyday financial goals. Advisors at United Advisor Group provide actionable advice and steady guidance that helps residents balance risk while building a solid financial foundation.

The community impact is visible in real-life examples where practical planning led to measurable improvements in asset allocation and long-term stability. The following story shows how hands-on support transformed a family’s financial plan into a secure future:

- Clear risk assessment techniques

- Transparent fee structures

- Personalized planning sessions

Frequently Asked Questions

What do wealth management services offer Cincinnati residents?

Wealth management services offer Cincinnati residents tailored financial planning, investment guidance, and virtual family office solutions that focus on securing long-term outcomes while supporting their unique financial needs.

How do key features benefit local investors?

Key features provide local investors with specialized support, flexible revenue models, and a unique family office experience. This setup empowers advisors to consistently deliver tailored financial solutions that meet diverse client needs.

How to choose the right wealth management firm in Cincinnati?

Choosing a wealth management firm in Cincinnati means examining their client-centered approach, support for advisors, and clear fee structures. One should focus on firms offering innovative tools that build recurring revenue and deliver a comprehensive family office experience.

What trends shape Cincinnati‘s wealth management sector?

Cincinnati‘s wealth management sector is evolving with virtual family office experiences, client-first strategies, and dedicated support that helps broker-dealer registered representatives secure recurring revenue and optimize marketing budgets.

What challenges do Cincinnati residents commonly face?

Cincinnati residents often face rising living costs, transportation delays, and limited access to quality care, prompting community efforts to improve local amenities while balancing work and life priorities.